south dakota sales tax rates by city

What is the sales tax rate in Hill City South Dakota. This is the total of state county and city sales tax rates.

Sales Tax Collection Increase In 2020 Gardnernews Com

The Hill City South Dakota sales tax is 400 the same as the South Dakota state sales tax.

. What is the sales tax rate in Prairie City South Dakota. For cities that have multiple zip codes you must enter or. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Rapid City South Dakota is. The minimum combined 2022 sales tax rate for Prairie City South Dakota is. The tax data is broken down by zip code and additional locality information.

The minimum combined 2022 sales tax rate for Black Hawk South Dakota is. What is the sales tax rate in Sturgis South Dakota. The minimum combined 2022 sales tax rate for Central City South Dakota is.

Lowest sales tax 45 Highest. They may also impose a 1 municipal gross. 57701 57702 and 57709.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. What is the total sales tax rate in South Dakota. An alternative sales tax rate of 65 applies in the tax region Box.

This is the total of state county and city sales tax rates. What is the sales tax rate in Black Hawk South Dakota. What is the sales tax rate in Central City South Dakota.

The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. 366 rows 2022 List of South Dakota Local Sales Tax Rates. Exemptions to the South Dakota sales tax will vary.

While many other states allow counties and other localities to collect a local option sales tax. This is the total of state county and city sales tax rates. 31 rows The latest sales tax rates for cities in South Dakota SD state.

The minimum combined 2022 sales tax rate for Hill City South Dakota is. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. The South Dakota Department of Revenue administers these taxes.

The minimum combined 2022 sales tax rate for Sturgis South Dakota is. The Rapid City South Dakota sales tax rate of 65 applies to the following three zip codes. Enter a street address and zip code or street address and city name into the provided spaces.

Find your South Dakota. There are a total of 290 local tax jurisdictions across the state. Click Search for Tax Rate Note.

South Dakota has 142 cities counties and special districts that collect a local sales tax in addition to the South Dakota state sales taxClick any locality for a full breakdown of local. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. What is the sales tax rate in Rapid City South Dakota.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. The base state sales tax rate in South Dakota is 45. This is the total of state county and city sales tax rates.

Free sales tax calculator tool to estimate total amounts. Our dataset includes all local sales tax jurisdictions in South Dakota at state county city and district levels. 45 South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6.

This is the total of state county and city sales tax rates. Municipalities may impose a general municipal sales tax rate of up to 2. Central City SD Sales Tax Rate.

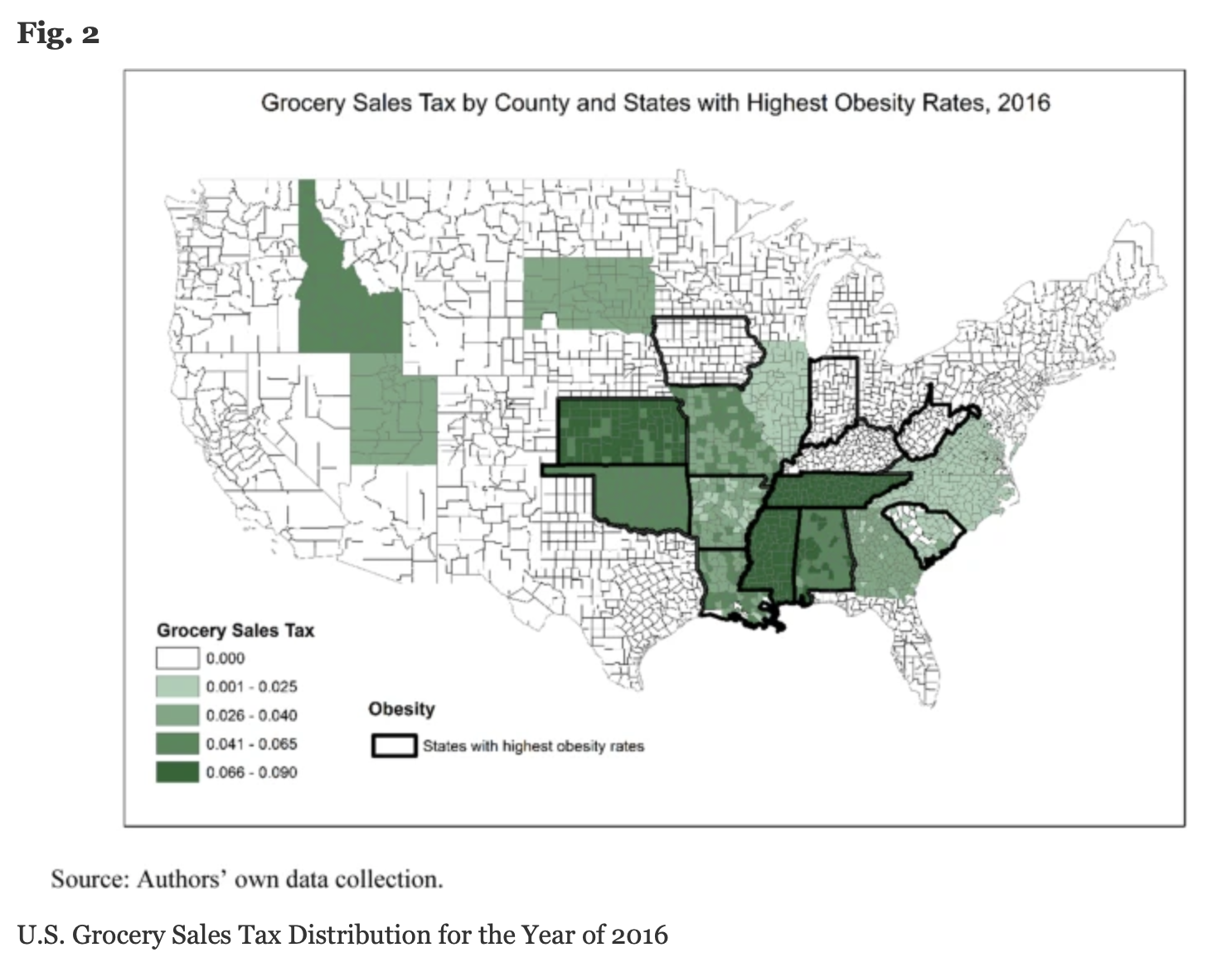

Make A Dollar By Taxing Food Spend 1 90 On Obesity And Diabetes Dakota Free Press

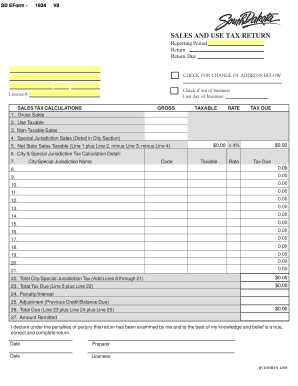

Fillable Online State Sd Sd Sales Tax Return State Of South Dakota State Sd Fax Email Print Pdffiller

General Sales Taxes And Gross Receipts Taxes Urban Institute

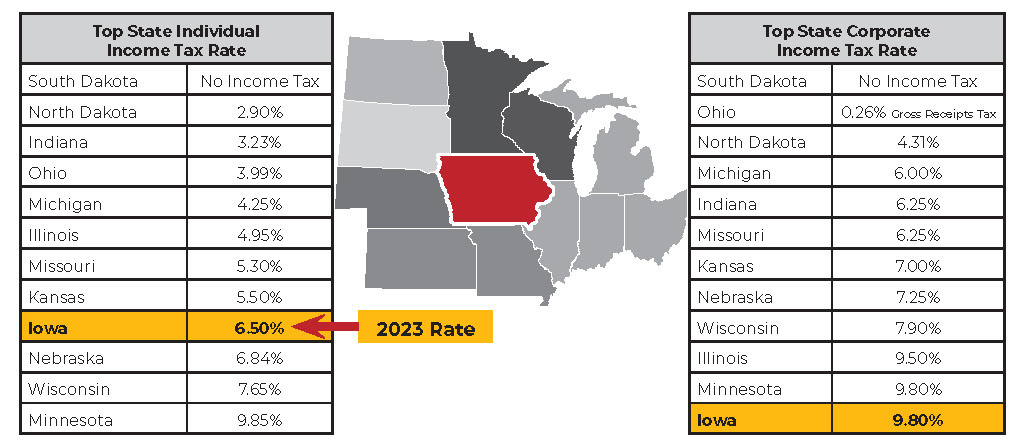

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Municipal Tax South Dakota Department Of Revenue

Cities With The Highest And Lowest Taxes Turbotax Tax Tips Videos

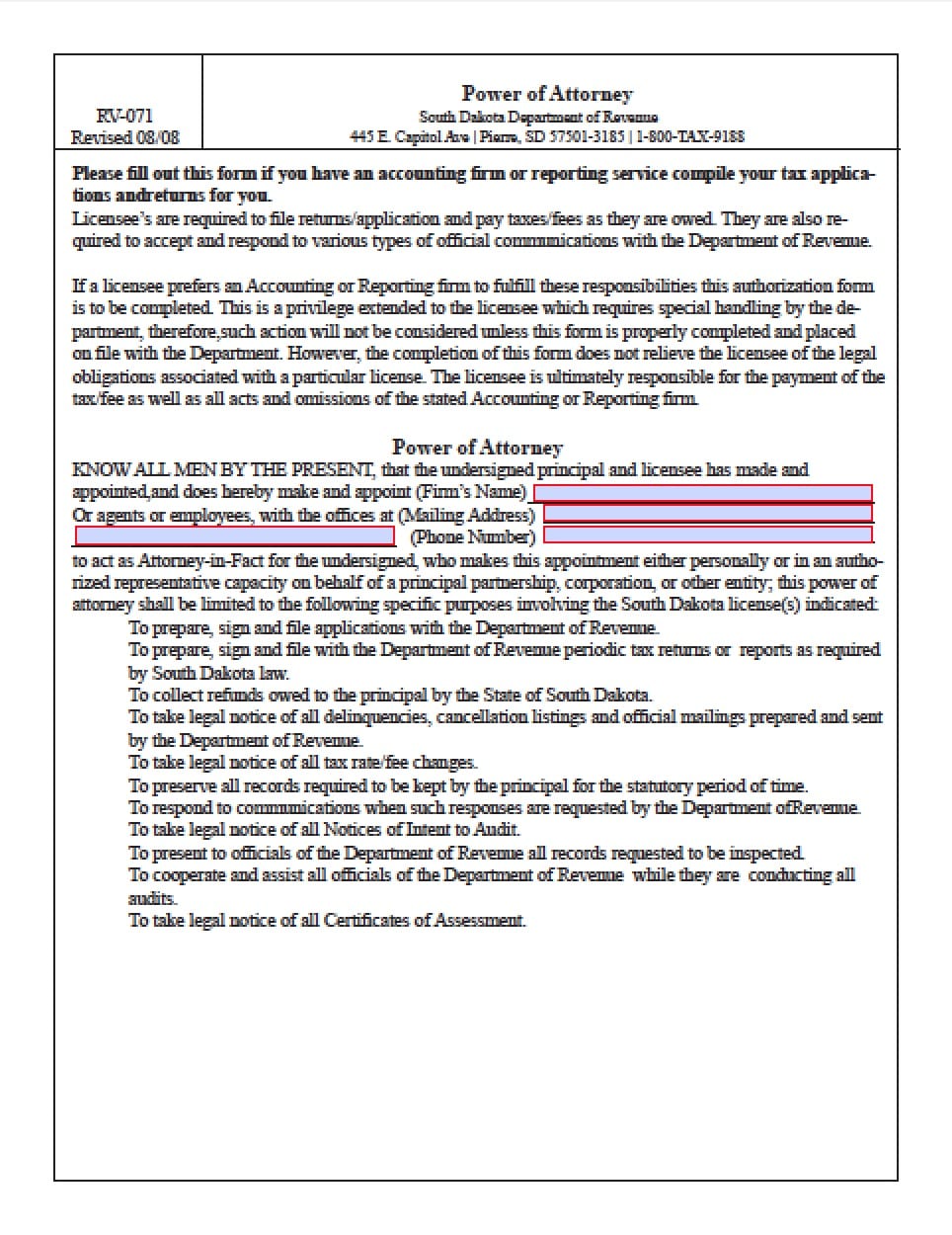

South Dakota Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

South Dakota Reports Spike In Sales Tax Growth In Latest Report

South Dakota No Tax On Food Avalara

How South Dakota Sales Tax Calculator Works Step By Step Guide 360 Taxes

South Dakota 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Understanding California S Sales Tax

Sales Tax Transactions Spike 13 5 In Past Fiscal Year Signaling Economic Growth

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts